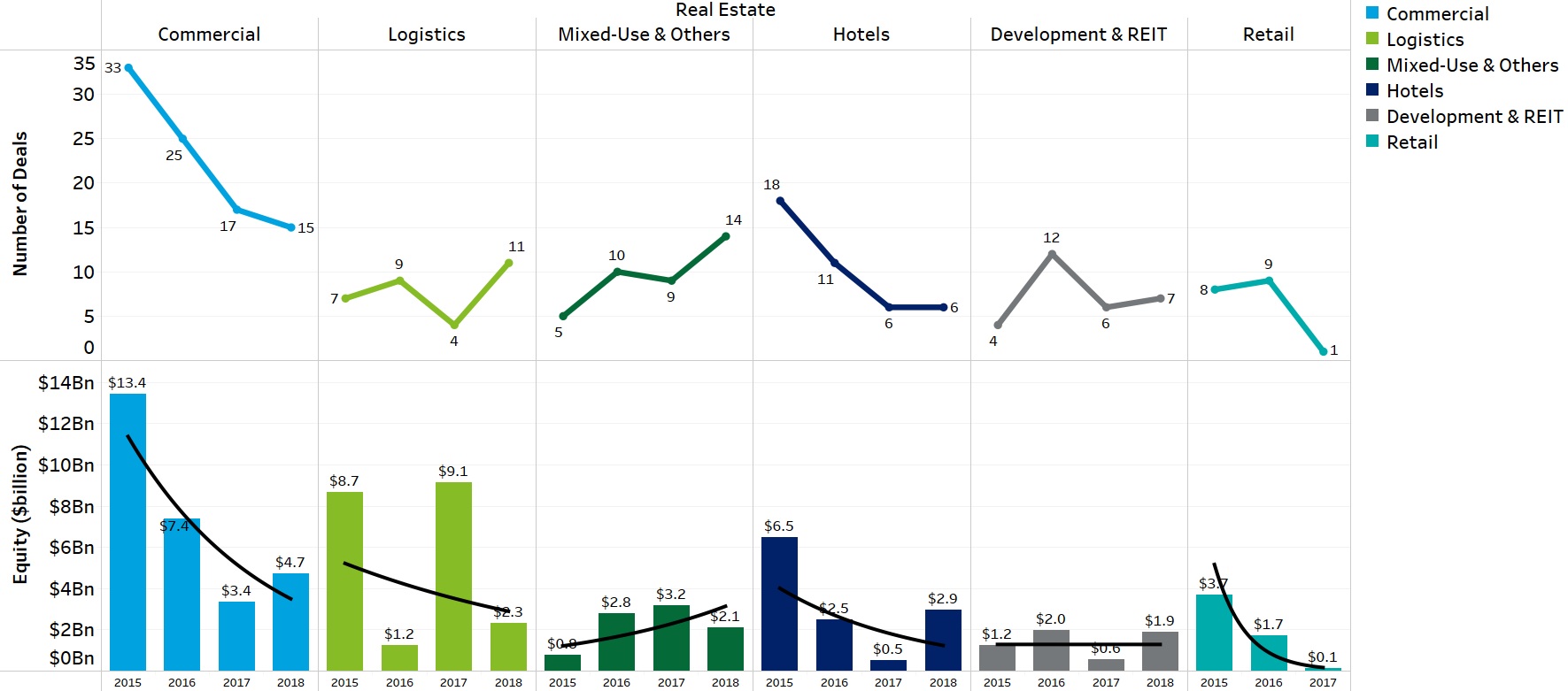

Many SWFs have realised that disruptive industries are going to have long-term consequences for the structure of a number of economic sectors such as retail, and they have started dedicating specific resources to ring-fence their portfolio against the next disruptive technology, some other are using investments in real estate as a proxy to invest in technology. In 2018, SWFs’ overall real estate direct investments reached the lowest equity value since 2015: $13.9 billion, less than half of the $34.3 billion they allocated in 2015. However, they closed 54 deals in 2018, 20% more than the 43 transactions closed in 2017. The median equity also increased slightly, reaching $150 million in 2018, up from $144 million in 2017.

Three trends have deeply changed the way SWFs invest in real estate: technology, urbanisation, and ageing populations.

Chart 3.1 SWF Investments in Real Estate sub-sectors: 2015-2018

Source: IFSWF Database

Technology

Very large sovereign wealth funds, often find it difficult or impractical to access venture capital as their sweet spot equity cheques of over $100 million are too large for startups. Buying data centres, warehouses or logistics platforms is, therefore, a good way for these SWFs to gain exposure to e-commerce and/or the next innovation. SWFs appear to have stopped investing in sectors that are already disrupted by e-commerce, such as retail malls. In 2017 there was only one investment in retail property, and in 2018 no transactions whatsoever, but in the once-unloved industrial and logistics sector we observed a record 11 transactions, or 20% of the total invested in the property sector. SWFs are also flocking to technology companies facilitating the logistics chain. For example Mubadala Ventures led the $60 million series B funding of Turvo, a real-time collaborative logistics platform that provides end-to-end visibility and collaboration for the logistics and supply chain industry.

Likewise, in February 2018, Singapore’s GIC partnered with Mount Elbert Capital Partners and Canadian pension fund OPTrust to launch EdgeCore Internet Real Estate, an $800 million investment platform to develop, acquire and operate data centres in North America. Lee Kok Sun, Chief Investment Officer of GIC Real Estate explained the rationale, “As a long-term value investor, we believe the secular growth in data consumption and public cloud usage will generate attractive returns in the data centre sector”.

Urbanisation

The majority of the world’s population now lives in cities. According to UN data, 55% of the world’s population now lives in urban areas, and this is projected to reach 68% by 2050, which would add another 2.5 billion people to urban areas by 2050. To harness this trend, SWFs are gradually increasing the amount they invest in Asia and Africa, which the UN forecasts will account for 90% of global demographic growth. SWFs invested $4.1 billion in Asian real estate in 2018, a 30% increase to the $3.2 billion in 2017, while their total investments in Africa quadrupled at the same time, reaching $400 million in 2018.

Increasing urban populations are pushing cities’ infrastructure to the limits, so some sovereign wealth funds are tapping companies working with cities to make them "smart”. For example, in 2018, the New Zealand Superannuation Fund, invested $65 million in Rubicon Global, a company that provides a technology platform for waste and recycling that connects businesses to a network of waste haulers.

Urbanisation also promotes micro-mobility, a trend in which sovereign wealth funds have been investing for the last three years, mainly financing car-sharing and bike-sharing companies. A noticeable example, when the fledgling electric scooter and bicycle startup LimeBike announced that GIC was one of the investors participating in the Series C round of $335 million.

Ageing populations

The Qatar Investment Authority – a sovereign wealth fund better known for its investments in hotels and resorts – has joined the group of investors seeking to target the wealth of the Baby Boomer generation as they age. In December 2018 the fund invested $300 million in US healthcare infrastructure specialist Welltower with an option to acquire an interest in a development pipeline of urban senior living communities. “QIA fully shares Welltower's view as to the enormous opportunity presented by investing in next-generation health care infrastructure, especially in view of the aging global population,” said Mansoor Ebrahim Al-Mahmoud, CEO of QIA. “We look forward to partnering with Welltower for the long-term, benefiting from their best-in-class platform and ability to create sustainable value.”

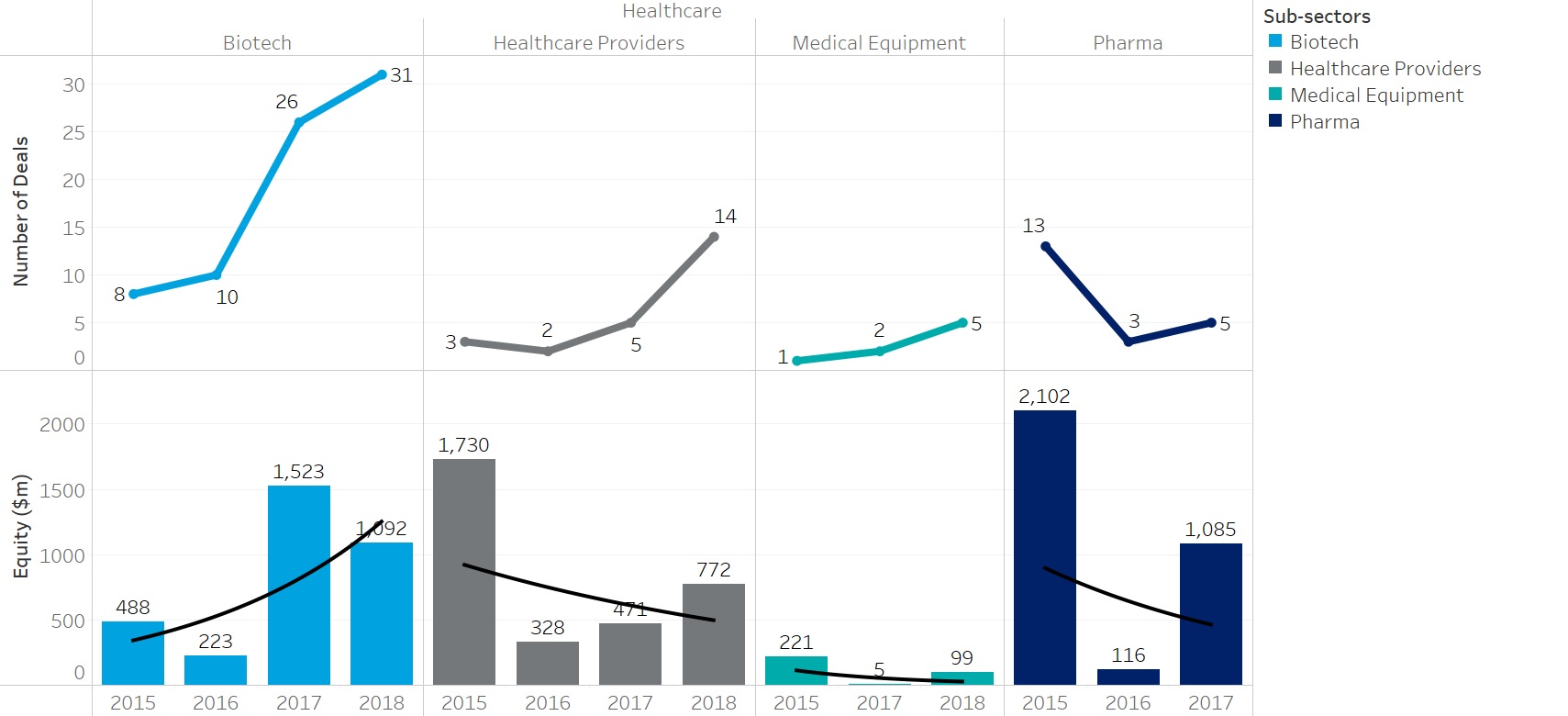

SWFs have long been investing along the trend of ageing populations globally, and it is not only reflected in the real estate sector but in healthcare, where hospitals and medical centres have gained in popularity in 2018 with 14 deals up from 5 the year before (as shown in the chart below).

Chart 3.2 SWF Direct Investments in Healthcare, by sub-sector.

Source: IFSWF Database